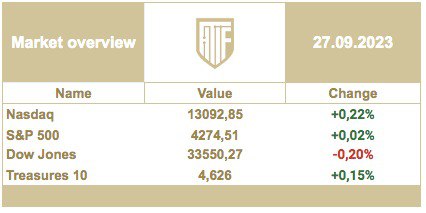

The U.S.stock market participants tried to play out an upward corrective movement in Wednesday's trading, but the end of trading turned out to be near zero changes on the main stock indices. All the concerns of the participants remain with them and it seems that the desire to form "short" positions in the market is beginning to cross some reasonable boundaries. This can be seen particularly well by the not-so-large level of cash flowing from the falling equity market into the sovereign debt market, which would be obvious now especially given the high yields on the debt. The synchronized declines in these markets are more indicative of the development of a "short" game - an attempt to profit from short-selling, which medium and small participants especially often go into. Historically high level of shorts on the market confirm this thesis. As for the sectors, the Real Estate and Utilities sectors looked like outsiders, the Energy sector was an obvious favorite of trades on the background of oil growth.