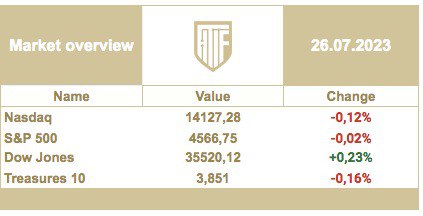

The decision on the U.S. Federal Reserve rate, which led to its rise by 0.25 percentage points, as well as the comments of the head of the Fed at the press conference, left market participants in some confusion. As a result , the main stock indices were at about zero values at the close of trading. On the one hand, the rate was raised, which negatively affects the stock market as a whole, on the other hand, the statement that further rate hikes are uncertain, the real estate market looks weak, and economic growth is a priority for the Fed, gives hope to market participants that the Fed is ready, at least, to pause in raising the rate, and at most this level, by the way, the maximum for the last 22 years, will still be a limit boundary, and further rate hikes will not follow. A number of major corporations have not "said their word" in quarterly reports yet and it seems that the focus of traders is smoothly shifting to this segment.