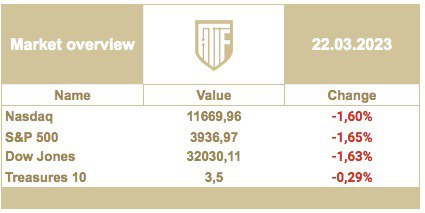

The released data on the US Federal Reserve's discount rate change by 0.25 percentage points encouraged investors, but D. Powell's subsequent speech put some doubts in the optimistic mood, which led to the markets closing in the negative zone. In his comments, Powell noted that U.S. inflation levels are far from comfortable, and the labor market remains strong, which unleashes further rate hikes. Despite the large number of questions on the banking system, the Fed Chairman did not express serious concern about its stability, thus provoking the market participants to think about the lack of control of the banking system, which shows the obvious signals of low stability, resulting in the rapid bankruptcies of banks from the top thirty, what is extremely strange for a "stable" banking system. The Financial and Real Estate sectors, which are also sensitive to interest rates, were under the biggest pressure.