Our strategy

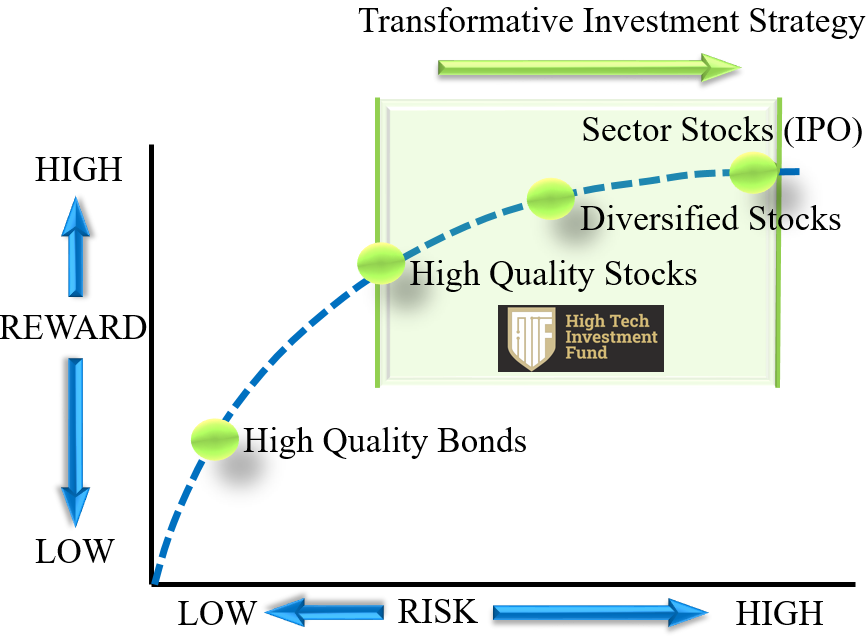

Different investors can have different investment objectives that can result in different ways they define, perceive, and subsequently manage and control risk. There's typically a direct relationship between the amount of risk involved in an investment and the potential amount of money it could make. Different types of investments fall all along this risk-reward spectrum.

HTIF’s transformative strategy focus over risk-reward spectrum

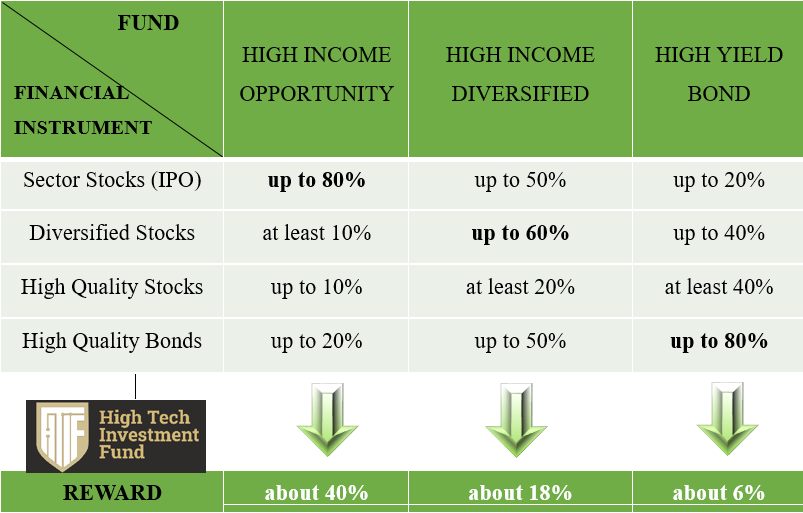

Thus, HTIF proposes three different Funds: High Income Opportunity Fund, Diversified High Income Fund, and High Yield Bond Fund, depending on the investment strategy, Financial Instruments ratio and risk mitigation as noted in the Table below.

Each Fund is actively managed. The degree to which the Fund may resemble the composition and risk characteristics of the benchmark will vary over time and its performance may be meaningfully different.

HTIF’s investment structure over affiliated Funds