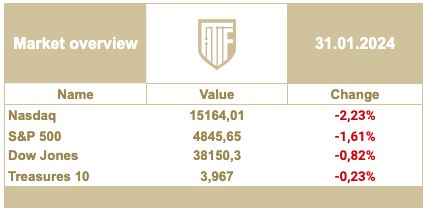

The reports of the first group of "monsters" were not so optimistic to justify their high level of quotations, and the Fed's speech, although it was soothing, still pushed back the expectations of the beginning of lowering the rates from March this year to May. All this, together with the factor of the end of the month, determined the movement of the main stock indices in Wednesday's trading, reducing them within 2.3 percentage points. The main charge of selling was felt in the Technology sector, where participants preferred to reduce positions in the "Magnificent Seven". At the same time, the Dow Jones 30 blue chip index showed a much smaller decline, making it clear that large funds are not yet inclined to dramatize the situation and continue to hold positions in industrial sectors. An alarming signal came from the Financial sector, where a significant weakness of banks, primarily related to mortgage lending, is seen.