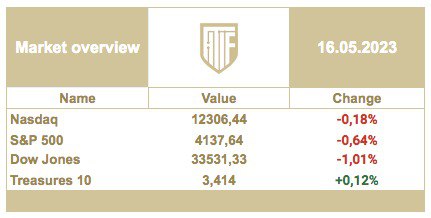

Tuesday's trading session on the U.S. stock market was held under the sign of a downward corrective movement. And if hi-tech Nasdaq lost insignificant 0,14 percentage points, the broad market index S&P500 has already lost about 0,6%, and the blue chips index Dow Jones more than one percent. This movement can be attributed to the fact that the big investment houses, whose weight is most significant in blue chips, have their hands tied and must consider the risk of a possible U.S. default in the absence of a decision to raise the sovereign debt ceiling. This uncertainty forces them to increase the share of cash in their portfolios, reducing the share in stocks in order to protect their conservative clients from possible negative consequences. Nasdaq market participants, on the other hand, take less account of this risk, relying primarily on corporate reports, which in this sector continue to be stable.